Mastering the intricacies of CPA exam regulations is crucial for exam success. Our comprehensive CPA exam regulation cheat sheet provides an invaluable roadmap, empowering you with the knowledge to navigate the complexities and maximize your score.

Delving into the heart of the exam, we’ll explore key regulations, their significance, and practical examples to enhance your understanding and boost your exam readiness.

CPA Exam Regulation Cheat Sheet

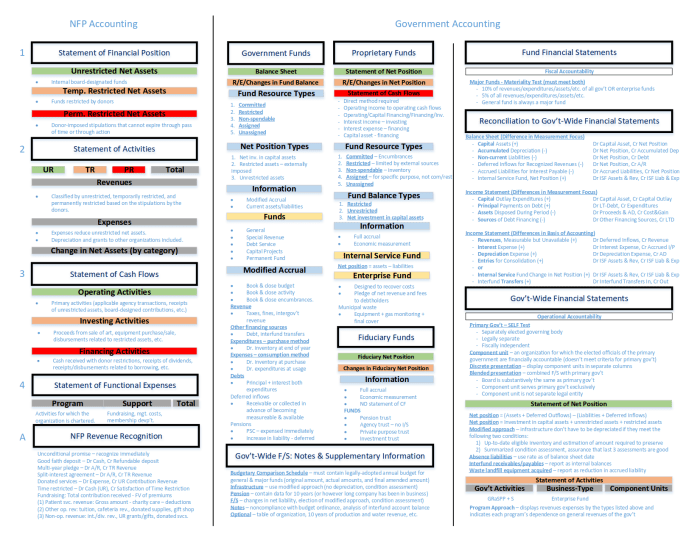

The CPA Exam Regulation cheat sheet serves as a comprehensive guide to the key regulations that candidates need to know for the CPA Exam. It provides a concise overview of the most important rules and regulations, helping candidates to quickly review and refresh their knowledge before the exam.

Key Regulations Covered

The CPA Exam Regulation cheat sheet typically covers the following key regulations:

- Sarbanes-Oxley Act of 2002 (SOX):Establishes corporate governance and financial reporting requirements for public companies.

- Internal Revenue Code (IRC):Governs federal income taxation in the United States.

- Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC):Provides the authoritative accounting principles for non-governmental entities in the United States.

- International Financial Reporting Standards (IFRS):Provides the authoritative accounting principles for public companies in the European Union and many other countries.

- Generally Accepted Auditing Standards (GAAS):Establishes the standards for auditing financial statements.

Content and Coverage

The CPA Exam Regulation Cheat Sheet covers a comprehensive range of regulations essential for passing the CPA exam. These regulations govern various aspects of accounting and auditing practices, ensuring compliance with ethical standards and legal requirements.

The cheat sheet includes the following key regulations:

- Sarbanes-Oxley Act of 2002 (SOX)

- Public Company Accounting Oversight Board (PCAOB) Standards

- International Financial Reporting Standards (IFRS)

- American Institute of Certified Public Accountants (AICPA) Code of Professional Conduct

- Statement on Auditing Standards (SAS)

These regulations are crucial for CPAs as they provide guidance on:

- Financial reporting and disclosure requirements

- Internal control systems and risk assessment

- Auditor independence and ethics

- Audit procedures and reporting standards

Sarbanes-Oxley Act of 2002 (SOX)

SOX was enacted in response to corporate scandals and aimed to enhance corporate governance and financial reporting transparency. It includes provisions such as:

- Establishment of the PCAOB to oversee accounting firms

- Enhanced financial reporting and disclosure requirements

- Increased auditor independence and accountability

Public Company Accounting Oversight Board (PCAOB) Standards

PCAOB Standards provide specific guidance on auditing and accounting practices for public companies. They include requirements for:

- Quality control systems for accounting firms

- Audit risk assessment and planning

- Internal control evaluation and testing

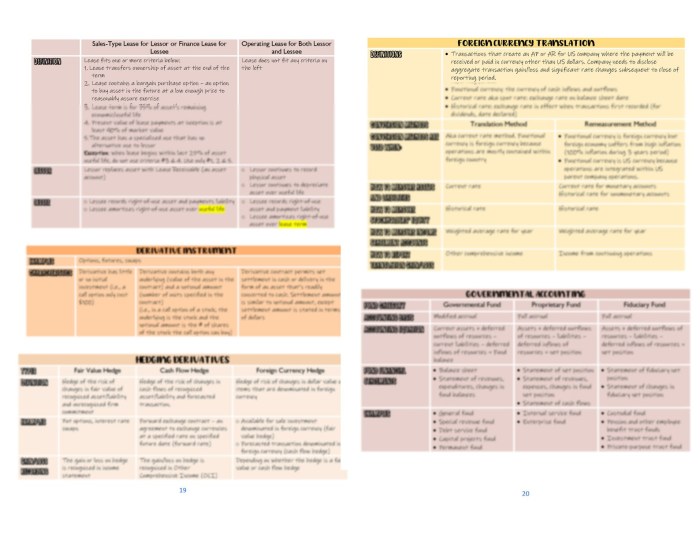

International Financial Reporting Standards (IFRS)

IFRS are a set of accounting standards used by companies in over 140 countries. They aim to harmonize financial reporting practices globally and include requirements for:

- Recognition, measurement, and presentation of financial statements

- Disclosure of significant accounting policies

- Consistency in financial reporting across different jurisdictions

American Institute of Certified Public Accountants (AICPA) Code of Professional Conduct

The AICPA Code of Professional Conduct establishes ethical standards for CPAs. It includes principles such as:

- Integrity and objectivity

- Due professional care

- Confidentiality

- Avoidance of conflicts of interest

Statement on Auditing Standards (SAS), Cpa exam regulation cheat sheet

SASs are issued by the AICPA and provide guidance on auditing procedures and reporting standards. They include requirements for:

- Planning and performing audits

- Evaluating internal control systems

- Reporting on audit findings

- Communication with audit committees

Presentation and Accessibility

To enhance the usability and effectiveness of the cheat sheet, prioritize clarity and accessibility in its presentation. Steer clear of technical jargon that may alienate users. Utilize bullet points, headings, and strategic formatting to improve readability and facilitate quick comprehension.

Visually Appealing Layout

Design the cheat sheet with a visually appealing layout that encourages quick reference and effortless navigation. This can be achieved through the use of contrasting colors, well-organized sections, and ample white space to enhance visual appeal and reduce cognitive load.

To ace the CPA exam, it’s crucial to master the regulations. However, if you’re also preparing for the Cset Multiple Subject Subtest 3 , you might want to consider a cheat sheet for the regulations. This will help you stay organized and recall the key points quickly.

Returning to the CPA exam, a cheat sheet can provide a concise overview of the complex regulations, making your revision more efficient and effective.

Distribution and Usage

The CPA Exam Regulation Cheat Sheet can be distributed through various channels, including:

- Online platforms:The cheat sheet can be made available for download on websites, online forums, and social media groups dedicated to CPA exam preparation.

- Printed materials:Physical copies of the cheat sheet can be distributed at workshops, seminars, and other CPA exam preparation events.

To effectively utilize the cheat sheet, candidates should:

- Review it regularly:The cheat sheet should be a constant companion during the exam preparation process. Candidates should regularly review the content to reinforce their understanding of key concepts.

- Use it as a study aid:The cheat sheet can be used as a quick reference guide while studying for the exam. Candidates can consult the cheat sheet to clarify concepts, refresh their memory, and identify areas where they need additional study.

- Practice using it under timed conditions:To simulate the exam experience, candidates should practice using the cheat sheet under timed conditions. This will help them develop the ability to quickly locate and use the information during the actual exam.

By following these tips, candidates can maximize the benefits of using a regulation cheat sheet and improve their chances of success on the CPA Exam.

Clarifying Questions: Cpa Exam Regulation Cheat Sheet

What is the purpose of a CPA exam regulation cheat sheet?

A CPA exam regulation cheat sheet serves as a concise and organized reference guide, providing quick access to key regulations relevant to the exam.

How can I effectively use the cheat sheet during my exam preparation?

Review the cheat sheet regularly, focusing on understanding the regulations and their implications. Use it as a quick reference during practice questions and mock exams to reinforce your knowledge.

What are some tips for maximizing the benefits of using a regulation cheat sheet?

Use the cheat sheet as a supplement to your main study materials. Highlight important points, create flashcards, and engage in active recall to enhance your retention.